AICD Governance Study Released

The Australian Institute of Company Directors has released its annual not-for-profit governance and performance study, which reveals that, while COVID-19’s effects on the sector were not so damaging as predicted, many organisations could take years to recover.

The institute’s NFP Governance and Performance Study is in its 12th year and remains the biggest governance report in the NFP sector. More than 1900 responded this year.

Last year’s study highlighted that, in many areas, the pandemic had intensified financial pressures that had existed before the pandemic, some of them caused by the bushfires of 2019-20.

This year’s study paints a more optimistic picture. Eighty-four per cent of respondents reported making a profit or breaking even in the 2020-21 financial year.

But 40 per cent said it would take at least two years to recover fully from the pandemic’s effects.

Eighty-one per cent of NFP directors worried about the strength of the Australian economy, and 95 per cent of organisations changed their business models to deliver services.

Other key findings were:

- 20 per cent of NFP directors wereremunerated (highest in the life of thestudy)

- 74 per cent of respondents reported thattheir time commitments were about the same, or somewhat more than the previous year

- 33 per cent reported that their boards had been operationally involved in their organisation’s responses to COVID-19

- 83 per cent of directors agreed that they were confident in their leadership team’s decision-making

- Merger activity was at a 10-year low, only 18 per cent of NFPs discussing merging in the next year. Only 1 per cent reported to be winding up their organisation, and

- 49 per cent of respondents believed that a post-COVID environment would create more opportunities for their organisation.

Manage Your Fraud Risk

The Australian Charities and Not-for-profits Commission’s governance toolkit includes resources to help charities manage risks, including financial abuse, cybersecurity, and working with partners.

Many charities develop working relationships with partners, which might be other charities and not- for-profits, businesses, commercial enterprises, and suppliers. Charities should ensure that their partner relationships are well-planned, supported by a solid written agreement, and pursue the agreed charitable purposes.

Charities should be aware of partnership risks and be confident that they have the right processes to manage one.

The toolkit includes a comprehensive guide and accompanying assessment, a template document for monitoring a partnership, and a list of important partnership considerations.

Since 1 January, some charities have been required to have a whistleblower policy.

The mandate applies to charities structured as public companies limited by guarantee with annual consolidated revenue of $1 million.

The Australian Securities & Investments Commission recently reviewed more than 100 whistleblower policies, including those of charitable companies, and found that most failed to include all the information required under the Corporations Act.

ASIC is concerned that whistleblowers will fail to get information about their legal rights and protections and how they can report misconduct. It is calling on companies, including charitable companies, to ensure that their policies comply with legal requirements and has published a guide explaining how to do it.

The commission recommends that all charities consider having a publicly-available whistleblower policy, even if they are not legally required to have one.

ACNC Urges use of Self-Audit Tool

Self-audits are among compliance initiatives introduced by the ACNC. By implementing a new program of self-audits, the ACNC says it is helping charities find and fix governance issues.

Along with other new compliance initiatives, self- audits allowed the ACNC to engage this year on compliance matters with 50 per cent more charities.

In an initial roll-out, 28 charities were involved. Seventy-five per cent of them provided a satisfactory response – 25 per cent of the charities were not up to standard.

Five of the 28 charities reported a plan to improve governance.

Of the charities that needed to improve, one found issues that came from rapid growth over 12 months. The charity had grown from small to large but had failed to upgrade governance to suit the more complex requirements for a larger charity. The charity acknowledged that addressing the gaps would ensure donor confidence and build broader community trust and confidence.

Your charity may download from the ACNC website a

The self- evaluation also includes a template for an action

plan.

Charity leaders need to get involved

Charity leaders should be active in their charities’ lives, the ACNC says.

An engaged board or committee is vital for a well- governed charity, so its leaders should be part of the approval and submission of an annual information statement.

The ACNC expects that a charity’s responsible people – directors, trustees, board and committee members – are fully aware of the content of their organisation’s AIS.

Charity leaders who take their duties and obligations seriously are critical in maintaining and building the confidence upon which the entire sector relies.

To ensure high standards of integrity and common sense, the responsibilities of charity leaders are set out in the ACNC’s governance standard 5. The standard requires that responsible people act honestly and fairly in the best interests of their charity and for its charitable purposes. They need to act with reasonable care and diligence, disclose conflicts of interest, and ensure that finances are well-managed. It also requires that responsible people don’t misuse their position or allow their charity to operate while it is insolvent.

To support sector transparency and accountability, the commission publishes on the register the names and positions of charities’ responsible people.

Charities must notify the commission of leadership changes, including new responsible people and those who have stepped down from their posts. Any role changes of responsible persons need to be reported.

New search features connect donors to charities

The ACNC’s charity register has new search features connecting more effectively donors with charities.

The register can be searched for charities based on type of programs they deliver, by beneficiary group, and program location.

Information on the register is based on details charities submit in their annual information statements.

Charities are encouraged to include as much program detail as possible. Providing a specific location or catchment area for where each program is delivered in the AIS will best take advantage of the new functionality, help programs to be found, and possibly boost support.

ACNC urges charities to comply

The ACNC urges charity leaders and their accountants to ensure that they comply with amended reporting regulations.

The amendments affect charity-size thresholds based on revenue, disclosure of remuneration for key management personnel, and disclosure of related-party transactions.

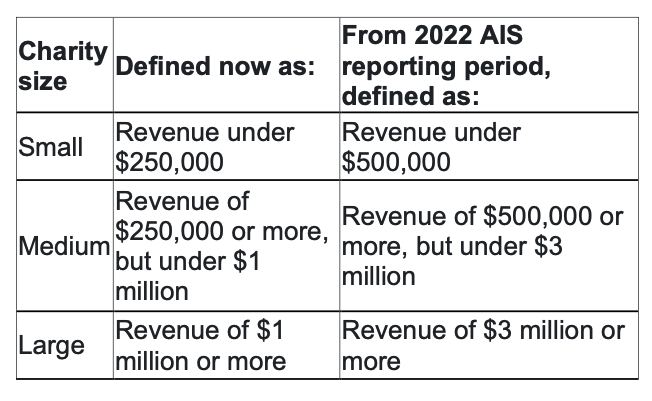

A charity’s ACNC financial-reporting obligations relate to size based on annual revenue. Medium and large charities must submit an annual financial report, while small charities are required only to submit an annual information statement.

From the 2022 AIS reporting period, revenue thresholds will rise for all three categories as follows:

The amendments will also require large charities to disclose in special-purpose financial reports remuneration of key management personnel. Key management personnel are senior managers and charity leaders such as directors, CEOs, and board members. The rule applies from the 2022 AIS reporting period.

For medium and large charities, there will be increased requirements to disclose related-party transactions in special-purpose financial statements. The change applies from the 2023 AIS reporting period.

The commission will exercise discretion for charities preparing special-purpose financial statements for the first time.

Charities preparing special-purpose financial statements for the first time under amended regulations will not have to provide comparative information for the preceding period in applying the relevant Australian accounting standard. They will need to provide disclosures for the reporting period only in the first year of adoption.

Helping NFP’s with best-practice reporting

Enhancing Not-for-Profit and Charity Reporting

by Chartered Accountants Australia and New Zealand guides not-for-profits and charities in how to prepare top-quality annual, financial, and performance reports.

The guide is in two parts.

Part A – Enhancing performance reporting is designed for charity and NFP organisations in Australia and New Zealand and draws on learnings from sector regulators and leaders in each country given the commonalities in annual and performance reporting.

It aims to help NFPs to identify and define their strategic objectives and then track, monitor, and report on their performance. It’s designed for organisations doing this kind of reporting for the first time, but others can benefit from information most relevant to them.

Part A contains these sections: setting the context for reporting, performance reporting, output and outcome reporting, governance reporting, sustainability and ESG reporting and collective impact, best-practice checklist, optional reporting frameworks, Australian and NZ councils for international development, codes of conduct, enhancing assurance, legislative frameworks, and useful resources.

Part B – Enhancing financial reporting consists of two separately published editions for each country, focusing on financial-reporting frameworks.

Part B (Aust) contains these sections: 20 recommendations to enhance NFP financial reporting, guidance when producing a financial report, frequently asked questions, and an example financial report.

Part B (NZ) contains these sections: on overview of New Zealand NFP and charity reporting requirements, recommendations to enhance NFP and charity financial reporting, guidance when producing a financial report, frequently asked questions, and future development.