New rules for meetings and documents give flexibility

Thousands of Australia’s registered charities will enjoy greater flexibility when staging meetings – as well as signing and executing documents – through recent amendments to federal legislation.

The changes are included in the Corporations Amendment (Meetings and Documents) Act, and cover charities that are registered under the Corporations Act.

The amendments make permanent temporary laws first introduced in response to the COVID-19 pandemic, allowing companies to execute and send documents electronically and hold virtual meetings.

The changes mean that:

Changes relating to signing and executing documents came into effect on 23 February. Changes about meetings come into effect on 1 April.

While the amendments provide a minimum standard, charities’ governing documents may require more. Charities must continue to comply with them, and those that are corporations could consider reviewing governing documents and seeking legal advice.

Changes to NFP tax exemption

While charities represent about a third of all not-for-profits, most NFPs don’t have a charitable purpose but may still self-assess as tax exempt and may include organisations formed to serve a specific aim, many meeting the requirements for special tax treatment.

Non-charitable organisations that can self- assess their exemption from income tax fall into eight categories: community service, cultural, educational, health, employment, resource development, scientific, and sporting.

NFPs that self-assess their own eligibility for income-tax exemption are not required to report their eligibility to the ATO.

Following reforms in last year’s federal budget, however, from 1 July, self- assessing NFPs with an active ABN will be required to lodge an annual self-review return with the information they ordinarily use to decide their eligibility for income-tax exemption.

The ATO has begun talks with the NFP sector to discover the types of guidance and support needed for NFPs to transition smoothly to the new requirements.

Consultations are expected to be concluded in June.

It is good governance practice to diarise an annual review of exempt status into your Board calendar.

You might need a director ID

A director ID is a unique 15-digit identifier that someone keeps forever. You may apply for one online at myGovID opting for ‘standard or strong’ identity strength.

Directors must apply personally so that identities can be verified. No one can apply on their behalf.

When you need to apply for the ID depends on when you became a director for the first time, and under which act you were appointed.

If appointed under the Corporations Act:

Aboriginal or Torres Strait Islander corporation directors have longer to apply.

For more information about who needs to apply and when, including a full list of key dates, visit the Australian Business Registry Services website.

Guidance for board secretaries

With the support of the Commonwealth Bank, the Institute of Community Directors has produced the free 48-page guide Damn Good Advice for Board Secretaries – Twenty-five questions every not-for-profit secretary needs to ask.

A good secretary is a good leader and a fount of knowledge about an organisation. She and he can keep your NFP on top of its governance obligations.

The new guide and its companions, Damn Good Advice for Board Members, Damn Good Advice for Treasurers and Damn Good Advice for Chairs, can help improve your understanding of governance roles within organisations.

To download the guide, go to https://communitydirectors.com.au/tools- resources/home.

Report examines how NFPs use financials

CPA Australia has released Annual Reports of Australian Not-For-Profit Organisations: Insights from Internal and External Stakeholders.

The report examines how:

NFPs are highly diverse, having varied legal structures, sizes, tax concessions, missions, activities and results.

CPA Australia wanted to discover who used NFP annual reports, what they wanted to know, whether their questions were answered, and whether report preparers knew what they needed to do.

Were there red-tape challenges, and what are the costs of NFP annual reporting?

As diverse as the participants, the findings were categorised under rubrics such as annual reporting, accountability, accounting standards, measuring outcomes, and risks.

Observations included:

compared with other NFPs and anomalies that this created

Updating charities’ work

Charities may now update on their Australian Charities and Not-for-profits Commission portals at any time details about their programs.

Previously, the inclusion of new information had been done annually through the annual information statement.

If charities developed a new program, a change of strategy, or had a crisis or disaster to respond to, they may now add changes in real time on the ACNC register.

Donors, volunteers, and philanthropists have endorsed the register, and visitor numbers continue to climb. The register helps charities showcase their work and reach out to key groups, including funders and grant-makers.

Governments and other funders often identify charities providing specific services to particular groups, and up-to-date information is now available.

Charities wanting to update information should select ‘Manage other charity details’ and an icon for ‘Changing your charity’s program’ on their portal.

For the first time, new charity register search features allow you to look up the kind of charity program you would like to support, in your local area or your preferred location anywhere in Australia. Donors, philanthropists, grant-makers and volunteers may use the register to find a cause close to their heart, while charities can use it to connect with each other.

Health check aims to improve boards

A new online health check aims to improve the boards of charitable organisations.

Developed and launched by Tanarra Philanthropic Advisors, The Board Health Check aims to help boards improve their effectiveness, boost performance, and focus better on their core purposes.

Believed to be the first resource of its kind in Australia, the ‘check’ contains information specific to charity boards.

Tanarra Philanthropic Advisors is a pro bono enterprise of the Tanarra alternative- asset investment group.

The ‘check’ may be used by Australian charities and not-for-profits, takes around 15 minutes to complete, and will help organisations uncover their key strengths, deficiencies, and potential issues.

The Governance Institute’s general manager of membership and engagement Leon Cox said the tool would allow charities to focus better on their core purposes.

‘To have a complimentary tool available to help charities govern their own entities means more time and resources can be directed into their own purpose and by extension better outcomes for society,’ Mr Cox said.

To find out more go to https://www.boardhealthcheck.org.

Know how to campaign and lobby legally

Advocacy and campaigning are important to the work of many of Australia’s registered charities.

Not only are they legitimate and effective ways of furthering charitable purposes, but charities’ ability to advocate and campaign remains an important part of Australian democracy.

With a federal election looming, it is important that charities and their responsible people ensure that any advocacy or campaigning complies with ACNC guidelines and does not threaten the charity’s registration.

The ACNC has written to at least one charity over material it was distributing that was likely to be construed as opposing a political candidate and party.

Charities are allowed to engage in advocacy or campaigning if these efforts:

Any advocacy or campaigning charities conduct must not:

Charities that make these errors risk losing their ACNC registration.

A charity may advocate for or against a change to a law, make a submission to a public consultation or inquiry, and produce material comparing the policies of political parties.

But in doing any of these things, charities must ensure that they are furthering their charitable purposes. Any advocacy must be permitted under a charity’s governing document and should not risk behaviour that constitutes a disqualifying political purpose.

Charities should also be conscious of how campaigning might affect their reputations. This is especially true in an election year, where there is an increased risk that the public could see it as promoting or opposing a particular political party or candidate.

Charities need to be aware of their responsibilities to all regulators whenever they undertake advocacy and campaigning – especially political campaigning.

AEC rules on charities’ campaigning

In addition to ACNC rules, charities and their responsible people should be familiar with obligations they might have to the Australian Electoral Commission if they spend money on campaigning or undertaking political advocacy.

Organisations, including charities, that spend money on campaigning or advocating on what are known as ‘electoral matters’ – communicating on issues with the dominant purpose of influencing how people might vote at the next election – might incur ‘electoral expenditure’.

Depending on the level of electoral expenditure, an organisation will be classed as either:

The expenditure threshold to be classed as a third party in 2021-22 is $14,000.

The threshold for a significant third party recently changed to $250,000 over a single financial year. The need to register as a significant third party also applies if an organisation’s electoral expenditure exceeds $250,000 in any of the previous three financial years.

Since July, registered charities that have reported political donations and electoral expenditure to the AEC have seen their ACNC charity-register listing updated to include links to the AEC’s transparency register.

Charities that comply with ACNC rules on advocacy and campaigning might still need to meet other regulators’ requirements.

Both the AEC and ACNC have useful guidance to help charities understand their advocacy obligations.

The tribunal found that Angel Loop’s purpose was to bring about a commercial deal between the investor and inventor. While ‘worthy’, the purpose was not incidental or ancillary to a charitable one, meaning Angel Loop was unable to be registered as a charity.

ACNC commissioner Dr Gary Johns said: ‘The Tribunal’s comments about purposes that are incidental or ancillary to a charity’s main purpose will continue to guide our assessments of charities’ ongoing entitlement to registration, including compliance with ACNC governance standards.’

So you want to become a charity

Each year thousands of new charities are established but more than half of applicants fail official registration.

Last financial year, the ACNC processed 5886 registration applications, registering 2659 new charities. Almost 2000 applications were incomplete, 862 were withdrawn, and 151 were refused as ineligible.

Before starting a charity, many things should be considered. Demonstrating what your organisation aims to achieve, its charitable purpose, is critical.

Your organisation’s purpose is what it has been set up to achieve – its mission. To be eligible to be registered as a charity it must have a charitable purpose that benefits the public.

The ACNC registers thousands of new charities every year, but applicants make common errors. Some tips follow to help your organisation demonstrate its mission.

Make sure your organisation:

If also applying to be registered as a charity sub-type (such as promoting human rights or advancing the natural environment) make sure your organisation’s governing document names the sub-type.

If applying for the sub-types Public Benevolent Institution and Health Promotion Charity and your organisation was only recently established, develop a strategic plan that sets out its activities for 12 months.

Governance standard 3 unaltered

Federal senators have blocked proposed laws aimed at cracking down on activist groups. The proposals would have given the ACNC the power to deregister charities for minor offences, even when it believed they were merely likely to occur.

Governance standard 3 remains unchanged and still applies. It requires charities not to act in a way that, under commonwealth, state and territory laws, could be an indictable offence (a serious crime that is generally tried by a judge and a jury), or a breach of law that has a civil penalty of 60 units ($12,600) or more.

The ACNC has identified some simple steps to reduce the risk of a charity’s breaching the standard. In most cases, common sense and good practice will reduce risk.

Charities should:

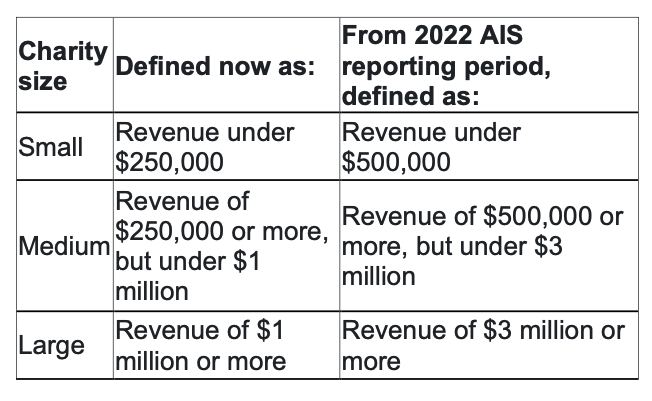

Charity thresholds change

Thresholds for determining a charity’s size are changing, and thousands of charities will see their reporting obligations reduced.

About 2500 charities will no longer be required to produce financial reports; only an annual information statement will be needed. About 2700 charities will be allowed to have their financial report reviewed instead of audited.

When charities complete their 2022 annual statements – which, for many, will cover a reporting period between 1 July 2021 and 30 June– the thresholds will change.

The table below compares old and new revenue thresholds for small, medium, and large charities.

|

Size of charity |

Current revenue thresholds

for the 2021 AIS |

Revenue thresholds from 1 July

2022 |

Audit/review requirement |

|

Small |

Less than

$250,000 |

Less than

$500,000 |

Must complete only an AIS

online |

|

Medium |

$250,000 - $999,999 |

$500,000 - $2,999,999 |

Financial report can be either

reviewed or audited |

| Large | $1 million or more | $3 million or more | Financial report must be audited |

While thresholds have changed, the following should also be considered:

Proposed amendments to NFP revenue standards

The Australian Accounting Standards Board’s exposure draft 318 is proposing amendments to illustrative examples for income of not-for-profit entities in AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities.

It proposes amendments to:

The amendments are proposed to apply to annual periods beginning on or after 1 July.

A basis for conclusions documents the AASB’s proposed intention to retain the accounting policy choice in AASB 16 Leases for not-for-profit private-sector lessees to elect to measure initially a class of concessionary right-of-use assets at cost or fair-value.

Inflation

MVA Bennett like many other businesses, including yours, is experiencing unprecedented cost pressures and this newsletter is to advise our valued clients that whilst we understand no-one wants to experience increased prices, we as a business, need to pass on some of these increases through fee increases of our own.

The Reserve Bank of Australia (RBA) has recently flagged inflation to peak around 7% in the second half of this year. Their target range is 2-3% so interest rates are on the increase as we already know. A normally low-key Phillip Lowe appeared on ABC TV to confirm this and the RBA’s determination to bring down inflation through increased interest rates.

The Fair Work Commission on 15 June, handed down a 5.2% or $40 wage increase to those on the National Minimum Wage.

We are seeing inflationary pressures throughout the world with the UK currently at 9% and USA at 8.6%. Australia is not living in isolation to these impacts.

Practically, we are all aware of the increased costs throughout the building sector regarding materials and labor due to supply and other factors outside our control. On the home front, floods have impacted the cost of living which has caused significant increases notably told in the media in respect to the cost of the humble lettuce.

No industry is immune to this which means that if they are to survive and continue to provide the services or products that their customers rightly expect, they need to look hard at their pricing. As our valued clients, we would expect you to also consider, very seriously, the movement in the costs of inputs to your business. Are these increases sustainable and is it now reasonable to pass some or all these increase onto your customers via price increases to your products or services?

At MVA Bennett, whilst we are not sourcing widgets for inputs into products. Our key input is labor and due to both a scarcity of resources as well as the wages increase within our industry, it is becoming increasingly difficult to reasonably absorb these increases. Increased fees whilst difficult to discuss, will ensure we can continue to support our valued clients and provide the advice they need and expect so they too, can navigate this time of change and uncertainty with us at their side.

We take this opportunity to thank you, as our valued client, for your continued support and good relations and to also offer our services to assist you in reviewing your own costing models to ensure your business is appropriately dealing with your inputs and any potential price increases that may be appropriate.

Director Identification Numbers

Australian directors have to apply for their unique director identification numbers before fines of more than $1.1 million kick in.

Company directors must apply for a DIN by 30 November this year, and directors of Indigenous corporations that are governed by the Corporations (Aboriginal and Torres Strait Islander) Act 2006 must apply for the unique identifier by 30 November 2023.

DIN applications are free. Applications must be made by each director (not their accountant) and are best done online through MyGov. We can assist as necessary.

More information can be found at https://www.abrs.gov.au/director-identification-number

Income tax 2022

The Australian Taxation Office has announced four key focus areas for Tax Time 2022:

The tax office is prioritising these areas to ensure there is an appropriate level of scrutiny on correct reporting of deductions and income.

Super changes starting 1 July 2022 - Employer communications

From 23 May to 2 June 2022, the Tax Office will be progressively sending a range of SMS, emails and letters to all employers letting them know about two important changes to super guarantee (SG). Most will receive this information by email.

The changes are:

Family and Discretionary Trusts

The Tax Office has announced comprehensive new scrutiny over trusts being used as vehicles to lower average tax rates particularly where the beneficiary does not actually receive the income that maybe attributed to them.

Our previous newsletters have covered this issue but as trust resolutions on income distributions are generally documented in these weeks leading up to 30th June ,this is a timely reminder that there are many considerations.

As always your MVAB team person is available to discuss all the matters contained in this newsletter as to their application to your particular circumstances.

Tax Update - Year End Approaches

This is the time of the year when tax accountants often do their most important work in preparing tax payers for the likely impost and looking for legal opportunities for minimisation or deferral.

Some of the opportunities include:

For individuals

o Superannuation Contributions

o Record keeping of business use of cars and homes

o Offsetting capital gains with losses

o Write-off of equipment bought for business usage

For businesses

o Writing off bad debts

o Revaluation of inventories

o Accelerated write offs

o Deferral of invoicing

o Acceleration of accruals

Superannuation Funds

o Payment of minimum pensions

Your MVAB advisor can elaborate on the application of these points to your circumstances

Federal Budget Announcements

The 120% deduction for skills training and technology costs

It’s a great headline isn’t it? Spend $100 and get a $120 tax deduction. Days after the Federal Budget announcement that businesses will be able to claim a 120% deduction for expenditure on training and technology costs, we started receiving marketing emails encouraging us to spend now to access the deduction.

But, there are a few problems. Firstly, the announcement is just that, it is not yet law. And, given the Government is in caretaker mode for the Federal election, we do not know the position of the incoming Government on this measure. And, even if the incoming Government is supportive, we are yet to see draft legislation or detail to determine the practical application of the measure.

What was announced?

The 2022-23 Federal Budget announced two ‘Investment Boosts’ available to small businesses with an aggregated annual turnover of less than $50 million.

The Skills and Training Boost is intended to apply to expenditure from Budget night, 29 March 2022 until 30 June 2024. The business, however, will not be able to claim the deduction until the 2023 tax return. That is, for expenditure between 29 March 2022 and 30 June 2022, the boost, the additional 20%, will not be claimable until the 2022-23 tax return, assuming the announced start dates are maintained if and when the legislation passes Parliament.

The Technology Investment Boost is intended to apply to expenditure from Budget night, 29 March 2022 until 30 June 2023. As with the Skills and Training Boost, the additional 20% deduction for eligible expenditure incurred by 30 June 2022 will be claimed in the 2023 tax return.

The boost for eligible expenditure incurred on or after 1 July 2022 will be included in the income year in which the expenditure is incurred.

Technology Investment Boost

A 120% tax deduction for expenditure incurred by small businesses on business expenses and depreciating assets that support their digital adoption, such as portable payment devices, cyber security systems, or subscriptions to cloud-based services, capped at $100,000 per annum.

We have received a lot of questions about the specific expenditure the boost might apply to, for example does it cover website development or SEO services? But until we see the legislation, nothing is certain.

Skills and Training Boost

A 120% tax deduction for expenditure incurred by small businesses on external training courses provided to employees. External training courses will need to be provided to employees in Australia or online, and delivered by entities registered in Australia.

Some exclusions will apply, such as for in-house or on-the-job training and expenditure on external training courses for persons other than employees.

We are waiting on further details of this initiative to be released to confirm whether there will need to be a nexus between the training program and the current employment activities of the employees undertaking the course. So once again, until we have something more than the announcement, we cannot confirm how the measure will apply in practice or how broad (or otherwise) the definition of skills training is.

What happens if I have already spent money on training and technology in anticipation of the bolstered deduction?

If the measure becomes law, and the start date of the measure remains the same, we expect that any qualifying expenditure incurred in the 2021-22 financial year will be claimed in your tax return. But, the ‘boost’, the extra 20% will not be claimable until the 2022-23 financial year.

If the measure does not come to fruition, you should be able to claim a deduction under normal rules for the actual business expense.

It should also be noted that, in the case of a company, the additional tax deductions obtained through the various incentives may only provide a deferral in the payment tax, as there may be insufficient franking credits to attach to retained earnings when it comes time to pay out dividends to members. Therefore, members will receive a partially unfranked dividend, and would be required to pay all of the tax on that part with no credit for tax paid by the company.

Fuel tax credit changes

The Government temporarily halved the excise and excise equivalent customs duty rates for petrol, diesel and all other petroleum-based products (except aviation fuels) for 6 months from 30 March 2022 until 28 September 2022. This action has caused a reduction in fuel tax credit rates.

During this 6 month period, businesses using fuel in heavy vehicles for travelling on public roads won't be able to claim fuel tax credits for fuel used for this purpose. This is because the road user charge exceeds the excise duty payable, and this reduces the fuel tax credit rate to nil.

You can find the ATO’s updated fuel tax credit rates that apply for the period from 30 March 2022 to 30 June 2022 here. The ATO’s fuel tax credit calculator has been updated to apply the current rates.

Lowering tax instalments for small business – PAYG

PAYG instalments are regular prepayments made during the year of the tax on business and investment income. The actual amount owing is then reconciled at the end of the income year when the tax return is lodged.

Normally, GST and PAYG instalment amounts are adjusted using a GDP adjustment or uplift. For the 2022-23 income year, the Government has set this uplift factor at 2% instead of the 10% that would have applied. The 2% uplift rate will apply to small to medium enterprises eligible to use the relevant instalment methods for instalments for the 2022-23 income year:

· Up to $10 million annual aggregated turnover for GST instalments, and

· $50 million annual aggregated turnover for PAYG instalments

The effect of the change is that small businesses using this PAYG instalment method will have more cash during the year to utilise. However, the actual amount of tax owing on the tax return will not change, just the amount you need to contribute during the year.

Section 100A and distributions to adult children

As previously advised, the ATO have issued Draft Ruling TR 2022/D1, which set out the ATO’s proposed approach to the treatment of “reimbursement agreements”.

The views set out in the Draft Ruling potentially affected the somewhat long standing and well accepted approach that families have had in the use of trusts and distributions to adult children.

Submissions closed on 29th April 2022, and we await the final version of documents to come from the ATO to provide further guidance in the lead up to 30 June 2022 to assist with the drafting of distribution resolutions.

The main point to note, at this stage, however, is that the ATO view does not prohibit the making of distributions to adult children should the trustee determine for that to occur. It merely solidifies the requirement, which has always been in place, that the beneficiary must ultimately benefit from the distribution. Furthermore, the ATO position indicates that documentation and tracking of transactions will become more important as time goes on for clients to clearly substantiate legitimate transactions should they be asked to do so.

We are conscious that there is uncertainty amongst the client base in relation to this matter, and seek to discuss the implications of the Draft Ruling when assisting with the drafting of distribution resolutions in the coming weeks.

An update from the ATO on this matter is provided in the link below.

Trust distributions to companies

The ATO recently released a draft tax determination dealing specifically with unpaid distributions owed by trusts to corporate beneficiaries. If the amount owed by the trust is deemed to be a loan then it can potentially fall within the scope of the integrity provisions in Division 7A. If certain steps are not taken, such as placing the unpaid amount under a complying loan agreement, these amounts can be treated as deemed unfranked dividends for tax purposes and taxable at the taxpayer’s marginal tax rate. The ATO guidance deals specifically with, and potentially changes, when an unpaid entitlement to trust income will start being treated as a loan depending on the wording of the resolution to pay a distribution. The new guidance applies to trust entitlements arising on or after 1 July 2022.

Your superannuation

Work-test repeal – enabling those under 75 to contribute to super

Currently, a work test applies to superannuation contributions made by people aged 67 or over. In general, the work test requires that you are gainfully employed for at least 40 hours over a 30 day period in the financial year.

From 1 July 2022, the work-test has been scrapped and individuals aged younger than 75 years will be able to make or receive non-concessional (including under the bring-forward rule) or salary sacrifice superannuation contributions without meeting the work test, subject to existing contribution caps.

The work test will still apply to personal deductible contributions.

This change will also see those aged under 75 be able to access the ‘bring forward rule’ if your total superannuation balance allows. The bring forward rule enables you to contribute up to three years’ worth of non-concessional contributions to your super in one year.

Downsizer contributions from age 60

From 1 July 2022, eligible individuals aged 60 years or older can choose to make a ‘downsizer contribution’ into their superannuation of up to $300,000 per person ($600,000 per couple) from the proceeds of selling their home. Currently, you need to be 65 years or older to utilise downsizer contributions.

Downsizer contributions can be made from the sale of your principal residence that you have owned for the past ten or more years. These contributions are excluded from the age test, work test and your total superannuation balance (but not exempt from your transfer balance cap).

First home saver scheme – using super to save for a first home

The First Home Super Saver Scheme enables first home buyers to withdraw voluntary contributions they have made to superannuation and any associated earnings, to put toward the cost of a first home. At present, the maximum amount of voluntary contributions you can make and withdraw is $30,000. From 1 July 2022, the maximum amount will increase to $50,000. The benefit of this scheme is the concessional tax treatment of superannuation.

ATO ramps up heat on directors

Throughout March, the ATO sent letters to directors who are potentially in breach of their obligations to ensure that the company they represent has met its PAYG withholding, superannuation guarantee charge, or GST obligations.

These letters are a warning shot and should not be ignored.

The director penalty regime ensures that directors are personally liable for certain debts of the company if the debts are not actively managed. The liability applies to both current and former directors.

To recover this debt, the ATO will issue a director penalty notice to the individual directors. The ATO can then take action to recover the unpaid amount, including:

· By issuing garnishee notices,

· By offsetting tax credits owed to the director against the penalty, or

· By initiating legal recovery proceedings against the director.

In some cases it is possible for the penalty to be remitted but this depends on when the PAYGW, GST or SGC amounts are reported to the ATO. For example, in some cases the penalty can be remitted if an administrator or small business restructuring practitioner is appointed to the company, or the company begins to be wound up. However, this is normally only possible for PAYGW and GST amounts if they are reported to the ATO within 3 months of the due date. For SGC amounts this is only possible if the unpaid amount is reported by the due date of the SGC statement.

If the unpaid amounts are not reported to the ATO by the relevant deadline then the only way for the penalty to be remitted is for the debt to be paid in full. Winding up the company at this stage will not make the liability of the directors go away.

If you have received a warning letter from the ATO or a director penalty notice then please contact us immediately.

New domain name changes could leave your business at risk

From 24 March 2022, anyone with a local connection to Australia (including businesses, associations and individuals) will be able to register a new category of domain name. These shorter simpler domain names will end in .au rather than .com.au, .net.au, .org.au, .gov.au or .edu.au. All Australian businesses will have until 20 September to reserve their .au equivalent domain name, then it becomes available to the general public.

This new category of domain name allows users to register shorter, more memorable online names; however it also creates another avenue for cybercriminals to conduct fraudulent cyber activities. Opportunistic cybercriminals could register your .au domain name in an attempt to impersonate your business.

For example, if you have currently registered yourbusiness.com.au, a cybercriminal could register yourbusiness.au or yourbusinesscom.au and use these domains to conduct fraudulent cyber activities.

How to protect yourself

To help protect your business from opportunistic cybercriminals, the Australian Cyber Security Centre (ACSC) recommends that all Australian businesses with existing domain names register their .au equivalents before 20 September 2022. If a business does not reserve their .au equivalent direct domain name during this six-month period, that name will become available to the public on a first come, first served basis.

You can reserve your .au domain name by visiting an auDA accredited registrar.

Further information on these changes and the registration process is available on auda.org.au/au-domain-names:

Budget 2022-2023

Key initiatives include:

But, it is also a Budget that drives digitisation. Not just to support innovation but to streamline compliance, create transparency and more readily identify anomalies. Single touch payroll was the first step, the PAYG instalment system, trust compliance, and payments to contractors are next.

Beyond compliance, there is an opportunity capitalise on the benefits of the Government’s push towards innovation and investment in new technology. Not just the $120 tax deduction for every $100 spent on training employees and digital adoption, but also the expansion of the patent box tax concessions. There are opportunities for those pushing boundaries.

Please click on the below image to access our full client guide.

If we can assist you to take advantage of any of the Budget measures, or to risk protect your position, please let us know.

As always, we’re here if you need us!

Taxation of Trusts

Time to review the operation of your family discretionary trusts.

The Australian Taxation Office has recently released guidance explaining their attitude to the use of trusts including the non-payment of accrued loan accounts in trusts and the use of income distributed for tax purposes to children over 18years.

These are important announcements and must be considered by all trustees of discretionary or family trusts.

It is common for trust income to be “distributed” by book entry making beneficiaries making presently entitled to trust income.

Sometimes (though much less commonly), a beneficiary's present entitlement to a share of trust income arises out of, or in connection with, an arrangement:

In these cases, section 100A of the Income Tax Assessment Act 1936 generally applies to make the trustee, rather than the presently entitled beneficiary, liable to tax at the top marginal rate.

In simple terms it is important that income distributed to beneficiaries is paid to or applied for the purposes of those beneficiaries.

A more common example occurs when children reaching the age of 18 years are used to share trust income of the parents after paying tax at their generally lower marginal tax rate. The Tax Office is concerned that taxpayers are entering into arrangements to avoid tax on the net income of the trust by utilising the lower marginal tax rate applying to the children in circumstances where the benefit from these arrangements is, in substance, enjoyed by the parents by:

A review of these arrangements by the Tax Office considers that the following consequences may arise:

While the Tax Office alert specifically considers arrangements involving the children of controlling individuals, they are also concerned about similar arrangements involving other family members of controlling individuals that would have lower marginal tax rates than those of the controlling individuals.

Our team will review the application of these announcements to client family trusts and it is strongly recommended that trustees or directors of trustee companies clearly understand their obligations in regards to these new requirements in particular.

Please contact your MVAB Team person if you would like to discuss the application of these announcements to your particular circumstances.

Real Estate

Planning for the consequences of increasing property values

Rising property values might seemingly fulfil the aspirations of many. However, there are unintended consequences which are worthy of thought and advice to optimise the situations.

Taxation

Governments of all persuasions love to tax property – what use to be restricted to a minority is now applying to many.

Council rates are prorated to municipal residents based on individual property values.

Council valuations are used by the State Government to levy Land Tax. Objections to valuations for Land Tax purposes need to be aimed at the Council who may determine the value at a time when the Land Tax assessment is not current and thereby missing the opportunity to object to the valuation within required timeframes.

The principal place of residence is generally exempt from Land Taxes and Capital Gains Tax. However, when is a house a Principal Residence – can a holiday house gain exemption – can a couple have more than one Principal Residence – what happens if the Principal Residence is rented out for part of the year?

As an example, if the holiday home land value was $500,000, the land tax would be c $ 775. At $1,000,000 the land tax is $2,975 and at $2,000,000 the land tax is $12,475. These amounts can be even higher if there is more than one property that is not a Principal Residence, or if the land is owned in a trust. The land tax increases exponentially compared to increases in the land value.

So what to do:

· Subdivide the land subject to Council rules?

· Rent out the house to recoup some monies and to make some or all of the taxes tax deductible

· Sell up and suffer the capital gains tax

Succession

Succession is inevitable and in a previous generation was generally caused by a death in the family. Nowadays, with generally longer life spans, succession is starting to happen while two or more generations are alive and hopefully well.

Transfers of properties outside a Will attract stamp duty which tends to discourage dealing with inter-generational transfers and puts off the inevitable. Putting off the inevitable can create differences of equity between beneficiaries by virtue of property prices rising faster than other asset classes.

A common example is with farming families. More than one child but only one child is the farmer. Can the farm be passed to the farmer without causing a rift from unequal values? Should future tax liabilities (or lack thereof) attaching to land be considered at the time of division of assets?

The Relative Values of Assets

The real issue is the reassessment of life’s purposes.

· Does farming land become too expensive to farm?

· Is the beach house worth more than the family home?

Some farming land is realising monies beyond reasonable dreams and as such may enable opportunities to do other things that may never have been contemplated.

There are tax concessions for selling so called “small businesses” – so planning to come within these rules is highly recommended before the thresholds are exceeded.

The MVABennett Approach

We invite the conversation with our clients about relative values and the timing of asset sales.

In addition, the periodic review of Wills and estate planning is key.

Please contact your MVABennett team person if any of these matters resonate for you.

AICD Governance Study Released

The Australian Institute of Company Directors has released its annual not-for-profit governance and performance study, which reveals that, while COVID-19’s effects on the sector were not so damaging as predicted, many organisations could take years to recover.

The institute’s NFP Governance and Performance Study is in its 12th year and remains the biggest governance report in the NFP sector. More than 1900 responded this year.

Last year’s study highlighted that, in many areas, the pandemic had intensified financial pressures that had existed before the pandemic, some of them caused by the bushfires of 2019-20.

This year’s study paints a more optimistic picture. Eighty-four per cent of respondents reported making a profit or breaking even in the 2020-21 financial year.

But 40 per cent said it would take at least two years to recover fully from the pandemic’s effects.

Eighty-one per cent of NFP directors worried about the strength of the Australian economy, and 95 per cent of organisations changed their business models to deliver services.

Other key findings were:

Manage Your Fraud Risk

The Australian Charities and Not-for-profits Commission’s governance toolkit includes resources to help charities manage risks, including financial abuse, cybersecurity, and working with partners.

Many charities develop working relationships with partners, which might be other charities and not- for-profits, businesses, commercial enterprises, and suppliers. Charities should ensure that their partner relationships are well-planned, supported by a solid written agreement, and pursue the agreed charitable purposes.

Charities should be aware of partnership risks and be confident that they have the right processes to manage one.

The toolkit includes a comprehensive guide and accompanying assessment, a template document for monitoring a partnership, and a list of important partnership considerations.

Since 1 January, some charities have been required to have a whistleblower policy.

The mandate applies to charities structured as public companies limited by guarantee with annual consolidated revenue of $1 million.

The Australian Securities & Investments Commission recently reviewed more than 100 whistleblower policies, including those of charitable companies, and found that most failed to include all the information required under the Corporations Act.

ASIC is concerned that whistleblowers will fail to get information about their legal rights and protections and how they can report misconduct. It is calling on companies, including charitable companies, to ensure that their policies comply with legal requirements and has published a guide explaining how to do it.

The commission recommends that all charities consider having a publicly-available whistleblower policy, even if they are not legally required to have one.

ACNC Urges use of Self-Audit Tool

Self-audits are among compliance initiatives introduced by the ACNC. By implementing a new program of self-audits, the ACNC says it is helping charities find and fix governance issues.

Along with other new compliance initiatives, self- audits allowed the ACNC to engage this year on compliance matters with 50 per cent more charities.

In an initial roll-out, 28 charities were involved. Seventy-five per cent of them provided a satisfactory response – 25 per cent of the charities were not up to standard.

Five of the 28 charities reported a plan to improve governance.

Of the charities that needed to improve, one found issues that came from rapid growth over 12 months. The charity had grown from small to large but had failed to upgrade governance to suit the more complex requirements for a larger charity. The charity acknowledged that addressing the gaps would ensure donor confidence and build broader community trust and confidence.

Your charity may download from the ACNC website a

The self- evaluation also includes a template for an action

plan.

Charity leaders need to get involved

Charity leaders should be active in their charities’ lives, the ACNC says.

An engaged board or committee is vital for a well- governed charity, so its leaders should be part of the approval and submission of an annual information statement.

The ACNC expects that a charity’s responsible people – directors, trustees, board and committee members – are fully aware of the content of their organisation’s AIS.

Charity leaders who take their duties and obligations seriously are critical in maintaining and building the confidence upon which the entire sector relies.

To ensure high standards of integrity and common sense, the responsibilities of charity leaders are set out in the ACNC’s governance standard 5. The standard requires that responsible people act honestly and fairly in the best interests of their charity and for its charitable purposes. They need to act with reasonable care and diligence, disclose conflicts of interest, and ensure that finances are well-managed. It also requires that responsible people don’t misuse their position or allow their charity to operate while it is insolvent.

To support sector transparency and accountability, the commission publishes on the register the names and positions of charities’ responsible people.

Charities must notify the commission of leadership changes, including new responsible people and those who have stepped down from their posts. Any role changes of responsible persons need to be reported.

New search features connect donors to charities

The ACNC’s charity register has new search features connecting more effectively donors with charities.

The register can be searched for charities based on type of programs they deliver, by beneficiary group, and program location.

Information on the register is based on details charities submit in their annual information statements.

Charities are encouraged to include as much program detail as possible. Providing a specific location or catchment area for where each program is delivered in the AIS will best take advantage of the new functionality, help programs to be found, and possibly boost support.

ACNC urges charities to comply

The ACNC urges charity leaders and their accountants to ensure that they comply with amended reporting regulations.

The amendments affect charity-size thresholds based on revenue, disclosure of remuneration for key management personnel, and disclosure of related-party transactions.

A charity’s ACNC financial-reporting obligations relate to size based on annual revenue. Medium and large charities must submit an annual financial report, while small charities are required only to submit an annual information statement.

From the 2022 AIS reporting period, revenue thresholds will rise for all three categories as follows:

The amendments will also require large charities to disclose in special-purpose financial reports remuneration of key management personnel. Key management personnel are senior managers and charity leaders such as directors, CEOs, and board members. The rule applies from the 2022 AIS reporting period.

For medium and large charities, there will be increased requirements to disclose related-party transactions in special-purpose financial statements. The change applies from the 2023 AIS reporting period.

The commission will exercise discretion for charities preparing special-purpose financial statements for the first time.

Charities preparing special-purpose financial statements for the first time under amended regulations will not have to provide comparative information for the preceding period in applying the relevant Australian accounting standard. They will need to provide disclosures for the reporting period only in the first year of adoption.

Helping NFP’s with best-practice reporting

Enhancing Not-for-Profit and Charity Reporting

by Chartered Accountants Australia and New Zealand guides not-for-profits and charities in how to prepare top-quality annual, financial, and performance reports.

The guide is in two parts.

Part A – Enhancing performance reporting is designed for charity and NFP organisations in Australia and New Zealand and draws on learnings from sector regulators and leaders in each country given the commonalities in annual and performance reporting.

It aims to help NFPs to identify and define their strategic objectives and then track, monitor, and report on their performance. It’s designed for organisations doing this kind of reporting for the first time, but others can benefit from information most relevant to them.

Part A contains these sections: setting the context for reporting, performance reporting, output and outcome reporting, governance reporting, sustainability and ESG reporting and collective impact, best-practice checklist, optional reporting frameworks, Australian and NZ councils for international development, codes of conduct, enhancing assurance, legislative frameworks, and useful resources.

Part B – Enhancing financial reporting consists of two separately published editions for each country, focusing on financial-reporting frameworks.

Part B (Aust) contains these sections: 20 recommendations to enhance NFP financial reporting, guidance when producing a financial report, frequently asked questions, and an example financial report.

Part B (NZ) contains these sections: on overview of New Zealand NFP and charity reporting requirements, recommendations to enhance NFP and charity financial reporting, guidance when producing a financial report, frequently asked questions, and future development.

ACNC Activities

The Australian Charities and Not-for-profits Commission is urging charities to check that they are maintaining their entitlement to registration.

They must ensure that they are still not-for-profit, their purposes are charitable, their activities lawful, that they are operating for the public benefit, and have an ABN.

ACNC commissioner Gary Johns said charities must maintain their entitlement to registration to avoid revocation. He said the ACNC recommended that charities build in a way of regularly checking their entitlement to registration. The ACNC had a tool to help charities make that assessment, he added.

Each registered charity has a record on the ACNC charity register and is obliged to have a governing document attached as well as a list of current responsible people.

Dr Johns said, ‘Common lapses include charities not keeping their records of responsible people up-to-date, or not having enough responsible people listed as required, and not having a governing document attached to their record [...].’

Charities must also ensure that their purposes and activities are aligned with their registered- charity subtype.

The seventh Australian Charities Report published in May showed that, on average, registered charities had been operating for 32 years.

Dr Johns said, ‘Over the long life-cycle of a charity many things can change, including boards and staff, so it’s crucial charities have an established process for [...] entitlement checks.

‘Our [...] register provides key information about Australian charities to the public. It is critical that this information is up to date because that demonstrates the integrity of the sector and its willingness to be transparent.

‘It is always of public interest to know how charities are run and by whom, how their funds are accrued and spent. Keeping those details accurate is therefore an important [...] task.’

The ACNC has information about maintaining charity registration and a checklist.

Go to https://www.acnc.gov.au/for- charities/manage-your-charity/obligations- acnc/keep-charity-status.

MVA Bennett can provide assurance to those charged with governance of compliance with the ACNC rules.

Hundreds of charities struck off

The ACNC has revoked the registrations of 420 Australian charities that have failed to submit two or more annual information statements.

ACNC assistant commissioner Anna Longley said the organisations were no longer eligible for certain Commonwealth tax concessions.

‘It is important that we keep the ACNC [...] register up-to-date and accurate,’ Ms Longley said.

The commission notified in August more than 600 charities that they risked being struck off the register.

‘We take steps to allow charities that are still active to have every opportunity to maintain registration,’ Ms Longley said.

‘Some charities have since submitted their overdue statements, [...] retained registration, and will continue to access generous commonwealth [...] tax concessions.’

Solvency Essentials

The ACNC’s governance requires a charity’s responsible persons to ensure that their charity is not operating while insolvent.

Charities must take reasonable steps to ensure its responsible persons fulfil duties set out in the standard.

For a charity that is a company, in addition to standard 5, duties set out in the Corporations Act 2001 apply to responsible persons (directors), including the duty to prevent insolvent trading. If a charity that is a company continues to operate while insolvent, its directors may be subject to legal action.

Charities incorporated as associations might also have responsibilities to their state and territory regulators.

The ACNC wants charities to be aware of warning signs that might indicate a charity is facing financial trouble.

The commission nominates:

Annual Information Statement

The ACNC’s 2021 Annual Information Statement Guide aims to help charities complete their annual information statements.

The commission recommends that you use the AIS checklist before filing your statement.

Unlawful behaviour

The federal government has tabled regulations in Parliament that strengthen governance standards, ensuring that registered charities do not engage in or actively promote unlawful activity.

The regulations reaffirm that compliance with Australian laws sets a minimum benchmark by which registered charities should govern themselves.

The changes will empower the ACNC commissioner to investigate registered charities engaging in or actively promoting theft, vandalism, trespass, and assault and threatening behaviour, and to take appropriate enforcement action if warranted.

Registered charities that act lawfully and do not use their resources to promote others to engage in unlawful activities already comply with the amended standards.

Charities will not be deregistered for inadvertent or unintentional non-compliance. Education underpins the ACNC’s regulatory approach, and revoking registration is reserved for serious and deliberate contraventions.

The ACNC will provide guidance to registered charities once the amended standard comes into effect to help them to understand and comply.